All comments are appreciated. We read every email, but can't always respond.

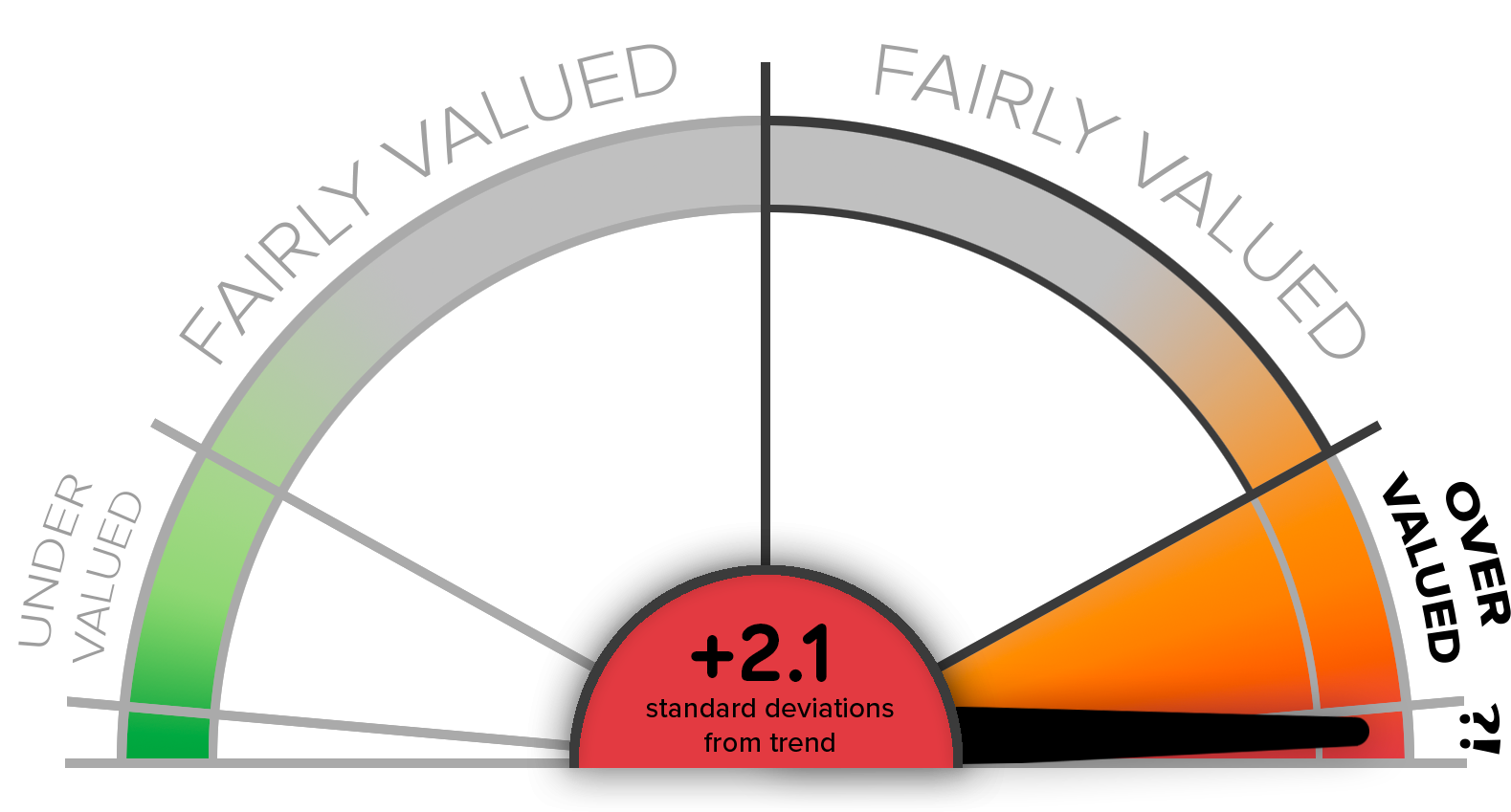

Aggregate Market Value Index

Updated January 23, 2026. The Aggregate Market Value Index model (AMVI) is a composite index of several of our market valuation models, providing a high-level view of current US stock market prices relative to historical valuation trends. This provides an idea of how overbought or oversold the market may be. The model is updated at least weekly.

While the intention is to present a view of overall market valuation, and therefore a signal as to market upside or downside, this is not a short term trading model. Markets can stay extremely under or over valued for long periods of time. Trying to time the market, even using long term business cycles such as this, has historically underperformed a buy-and-hold investment strategy.

Performance Return Horizons

AMVI Model Correlation w/S&P 1-Month Returns

- Scatterplot shows no clear pattern.

- On a scale of 0 to 1.00, the R-squared regression value is 0.01.

- Conclusion: There is absolutely no correlation at all between AMVI model score and subsequent 1-month S&P500 returns. This model has zero information about stock market returns 1 month out.

AMVI Model Correlation w/S&P 3-Month Returns

- Scatterplot shows no clear pattern.

- On a scale of 0 to 1.00, the R-squared regression value is 0.02.

- Conclusion: There is absolutely no correlation at all between AMVI model score and subsequent 3-month S&P500 returns. This model has zero information about stock market returns 3 months out.

AMVI Model Correlation w/S&P 1-Year Returns

- The scatterplot shows a very slight diagonal band of points, suggesting a trend is developing.

- There remain many data points in all four quadrants of the scatterplot.

- On a scale of 0 to 1.00, the R-squared regression value is 0.08.

- Conclusion: There is very little correlation between the AMVI model score and subsequent 1-year S&P500 returns.

AMVI Model Correlation w/S&P 3-Year Returns

- A slight trend is visible in the scatterplot.

- There are very few points in the lower left quadrant, showing it is quite rare for the model value to be below historic trend (less than 0), and for subsequent 3-year returns to be negative. Whereas negative returns are very frequent when model score is > 0.

- On a scale of 0 to 1.00, the R-squared regression value is 0.22. This is still quite small.

- Conclusion: There is some correlation between the AMVI model score and subsequent 3-year S&P500 returns.

AMVI Model Correlation w/S&P 5-Year Returns

- A clear trend is visible in the scatterplot.

- Almost all negative returns (left half of scatterplot) are from periods where model was at least slightly overvalued (model scores > 0).

- Even so, important to note that periods of lowest and highest 5-year returns came after relatively neutral model scores.

- On a scale of 0 to 1.00, the R-squared regression value is 0.37.

- Conclusion: There is moderate correlation between the AMVI model score and subsequent 5-year S&P500 returns.

AMVI Model Correlation w/S&P 10-Year Returns

- A clear trend is visible in the scatterplot.

- Every single instance of negative 10-year returns (left side of scatterplot) occurred when AMVI model was well above zero, and in almost every case > 1, showing Overvalued or Strongly Overvalued model scores.

- Likewise, every single instance of model undervaluation (> 1 standard dev below trend) was followed by very strong subsequent 10-year returns.

- Note, however, that the strongest instances of 10-year returns (rightmost points on scatterplot) came after model was only very slightly undervalued.

- On a scale of 0 to 1.00, the R-squared regression value is 0.58.

- Conclusion: There is moderately strong correlation between the AMVI model score and subsequent 10-year S&P500 returns.

Model Summaries

A quick visual update on each of our tracked models is below. The colored gauge represents a normal distribution curve - E.g., a model should be within +/- 1 standard deviation of its historical trend (considered to be Fairly Valued), about 66% of the time, reflected as the central gray area. Our Ratings Guide has more information.

NOTE: The Sahm Rule and State Coincidence Index models rely on data from federal statistical agencies that are unavailable because of the federal government shutdown. Updates to those models are delayed.

| Model | Updated | Rating | Score | Next Update | |

|---|---|---|---|---|---|

| Valuation Models | |||||

| Buffett Indicator | Jan 23 | Strongly Overvalued | 2.39 |

|

Jan 31 |

| Price/Earnings (CAPE) | Jan 23 | Strongly Overvalued | 2.27 |

|

Jan 31 |

| Price/Sales | Jan 23 | Strongly Overvalued | 2.60 |

|

Jan 31 |

| Interest Rate Model | Jan 23 | Overvalued | 1.81 |

|

Jan 31 |

| S&P500 Mean Reversion | Jan 23 | Strongly Overvalued | 2.33 |

|

Jan 31 |

| Earnings Yield Gap | Jan 23 | Fairly Valued | 0.44 |

|

Jan 31 |

| Recession Models | |||||

| Yield Curve | Jan 23 | Very High | 2.56 |

|

Jan 31 |

| Sahm Rule | Dec 31 | Normal | N/A |

|

Feb 07 |

| State Coincidence | Nov 30 | Normal | 0.31 |

|

Jan 31 |

| Sentiment Models | |||||

| Margin Debt | Dec 31 | Optimistic | 1.09 |

|

Feb 21 |

| Junk Bond Spreads | Jan 23 | Optimistic | 1.03 |

|

Jan 31 |

| VIX Index | Jan 23 | Neutral | -0.48 |

|

Jan 31 |

| Economic Uncertainty Index | Jan 23 | Very Pessimistic | 2.98 |

|

Jan 31 |

| Consumer Confidence | Jan 23 | Very Pessimistic | -2.30 |

|

Jan 31 |