Overview

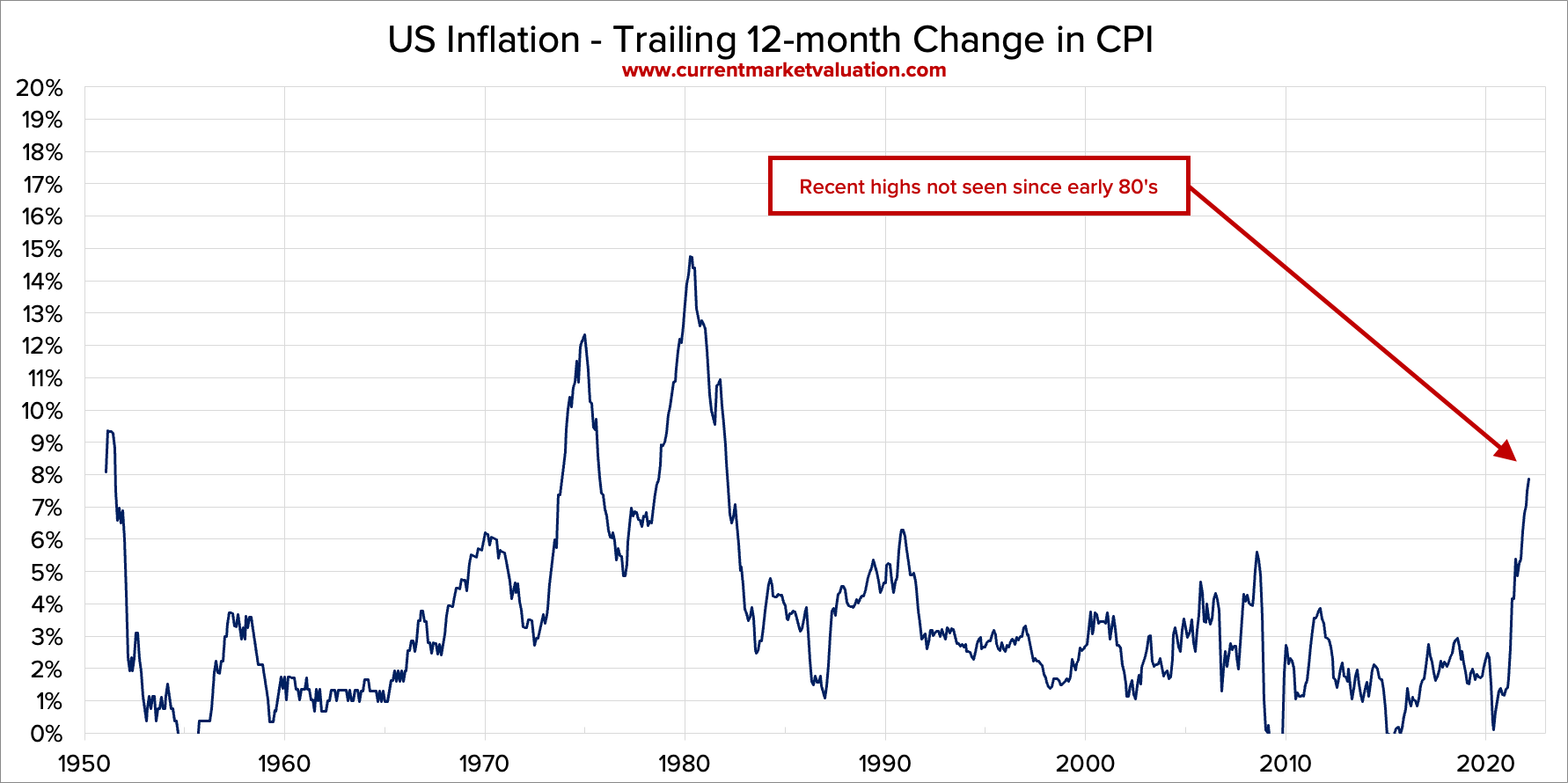

Inflation in the USA rose to 7.8% at the end of February, matching levels not seen since the early 1980's. Rising inflation has been headline news for the last year, this generation of Americans isn't accustomed to seeing such a surge in prices at the supermarket, gas pump, etc.

Transitory

For the last year or so, comments from the Fed have been that the current bout of inflation is 'transitory'. (They have recently begun walking back that language.) One of the explicit mandates of the Federal Reserve is to maintain long-term inflation of around 2%, so giant, generational deviations from that goal sure do catch their attention.

The idea behind temporary or 'transitory' inflation is that it is caused by factors that we reasonably expect to be temporary, and so for prices to naturally fall back down on their own. A simple example here is if a hurricane destroys an entire crop of a single good - let's say corn. If 50% of our corn supply were destroyed overnight, corn prices would skyrocket, as would all the downstream products that use corn as inputs (corn syrup, etc). Demand hasn't changed. People would still desire the same amount of corn and corn-based products, but because there is so much less corn to go around, the price of all those products would go up. The next season corn quantities would be normal, and so prices would fall back to regular levels.

Supply Chain

For the last two years, COVID-19 has materially disrupted global supply chains. As cities locked down in Asia, Europe, and finally the USA, there were massive disruptions to manufacturing, transportation, and generally all logistics globally. The impact of the virus on labor and logistics was massive. COVID also affected supply. As workers shifted to remote work globally, the demand for at-home products and services exploded, which in turn altered the required supply lines needed to fulfill the new demand.

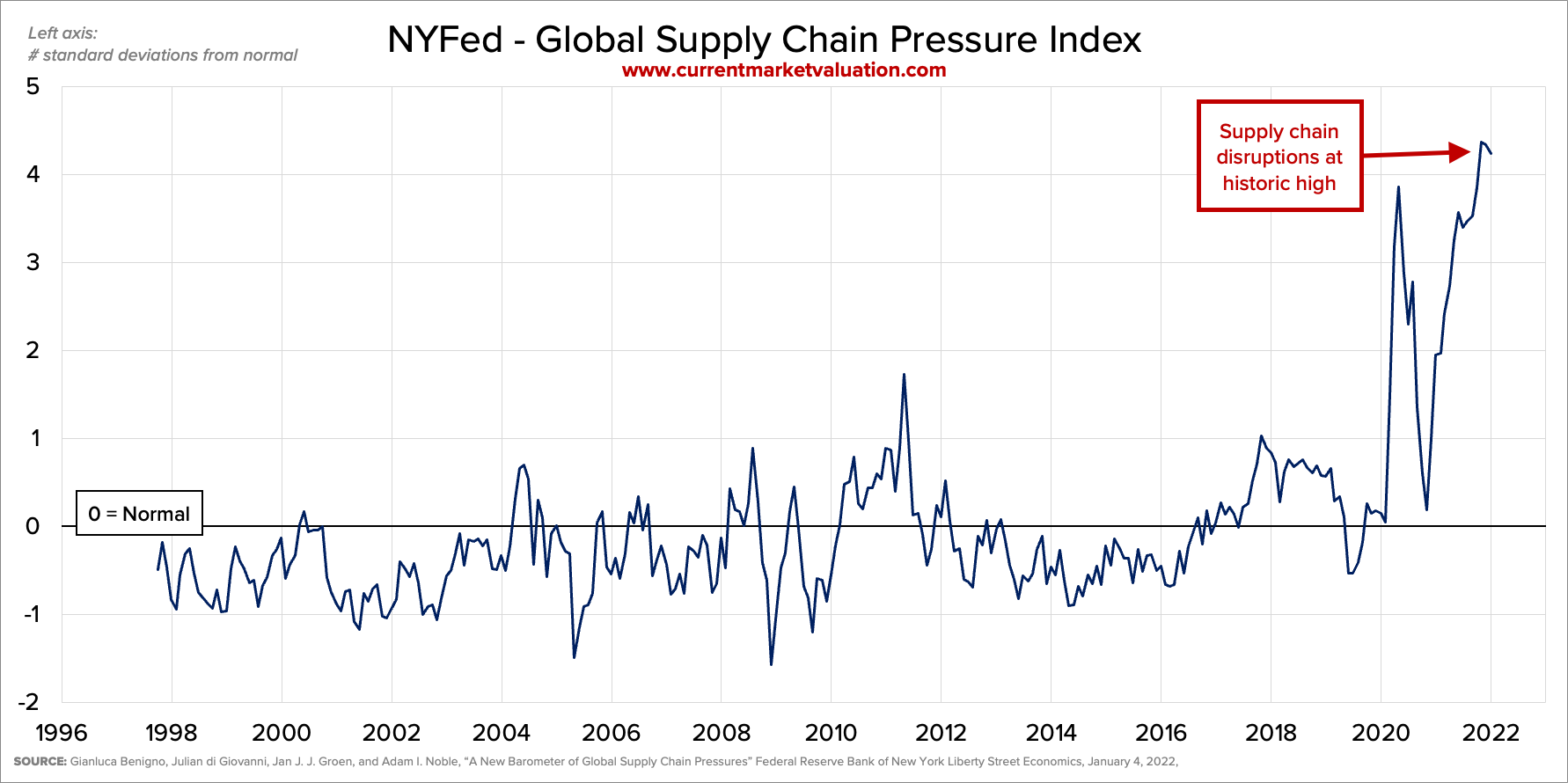

This year the NY Fed created a Global Supply Chain Pressure Index (shown below) to quantify this impact.

As the chart shows, the NYFed is measuring the pressure on global supply chains to be over 4 standard deviations above average; incredibly high. (The indicator considers a variety of different variables, detailed here). COVID made an immediate impact to global supply chains in early 2020, but by the end of the year almost recovered back to normal. Then, as Delta/Omicron variants caused additional turmoil, supply chain disruptions peaked again, to the current point.

This data supports the argument that supply-side disruptions are causing what should be temporary increases in prices, but begs the question: when will we return to normal for good?

Geopolitical Events

As these supply chain disruptions are peaking, Russia's invasion into Ukraine adds complexity to the situation. The various sanctions being imposed globally on Russia are impacting prices of many goods across the world. The most material driver is the increased cost of energy. Russia's main export is oil, and with sanctions limiting the amount of oil Russia can export, global energy costs have increased materially, which will increase costs of downstream products as well.

These disruptions may also be temporary, either as sanctions are lifted, or as the global energy market adjusts and increases supply in other areas (e.g., other countries increasing production, or a shift to other sources of energy).

But... When?

The key question is, at what point does a series of 'temporary' occurrences become permanent? Even if we can reasonably expect most of the current causes of inflation to dissipate over time... at what point does the inflation get baked in? At some point, restaurants will being reprinting menus with higher prices. Wages will begin to materially increase. These are sticky changes that will persist even after COVID dissipates. In this regard, "temporary" inflation is self-fulfilling, and will become permanent regardless of the original causes.

Fed Response

The Federal Reserve seems to agree. Today (March 16, 2022) they raised short-term interest rates by 0.25%, and indicated that they will do so again at each of the remaining seven FOMC meetings remaining this year. This is aggressive language that the Fed is very serious about controlling inflation, even at the risk of slowing down other economic growth due to the higher rates. Immediately after the announcement, portions of the yield curve began to flatten, and even invert. It seems the Fed is finally willing to apply pressure here.

In recent weeks the stock market has gone through a correction, so much so that our aggregate valuation model has fallen down to (the high end of) 'fairly valued'. Seven more rate hikes will put considerable pressure on equities, and the reduction in credit from the increased rates will damper economic growth. Conditions seem ripe for very bumpy roads ahead - should be an interesting year!

Other Valuation Models

Several of our core market valuation models cover this topic.