For Retail Investors

Retail memberships are intended for individual use only. If your use case involves advising clients or other redistribution or republication of our models, please contact us to learn about other options.

Free Newsletter

$0/yr

Early Access Newsletter: Monthly email update of select model ratings - sent out mid-month, about two weeks before public website updates.

Premium

Regular price $99/yr

Weekly Updates: Every CMV model updated weekly*

Enhanced Charts: Every chart on each model page becomes interactive, showing additional detail and zoom/scan capability

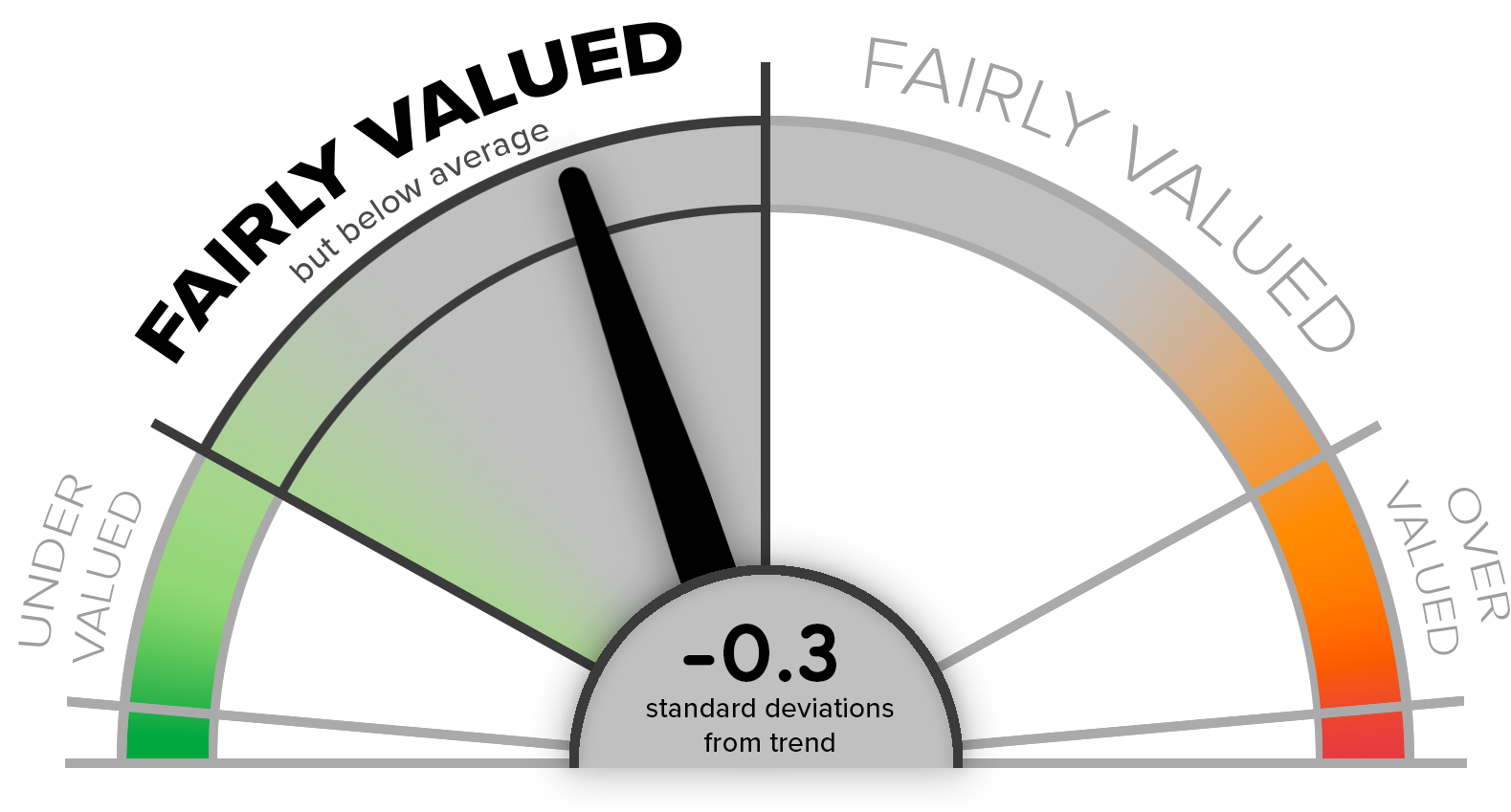

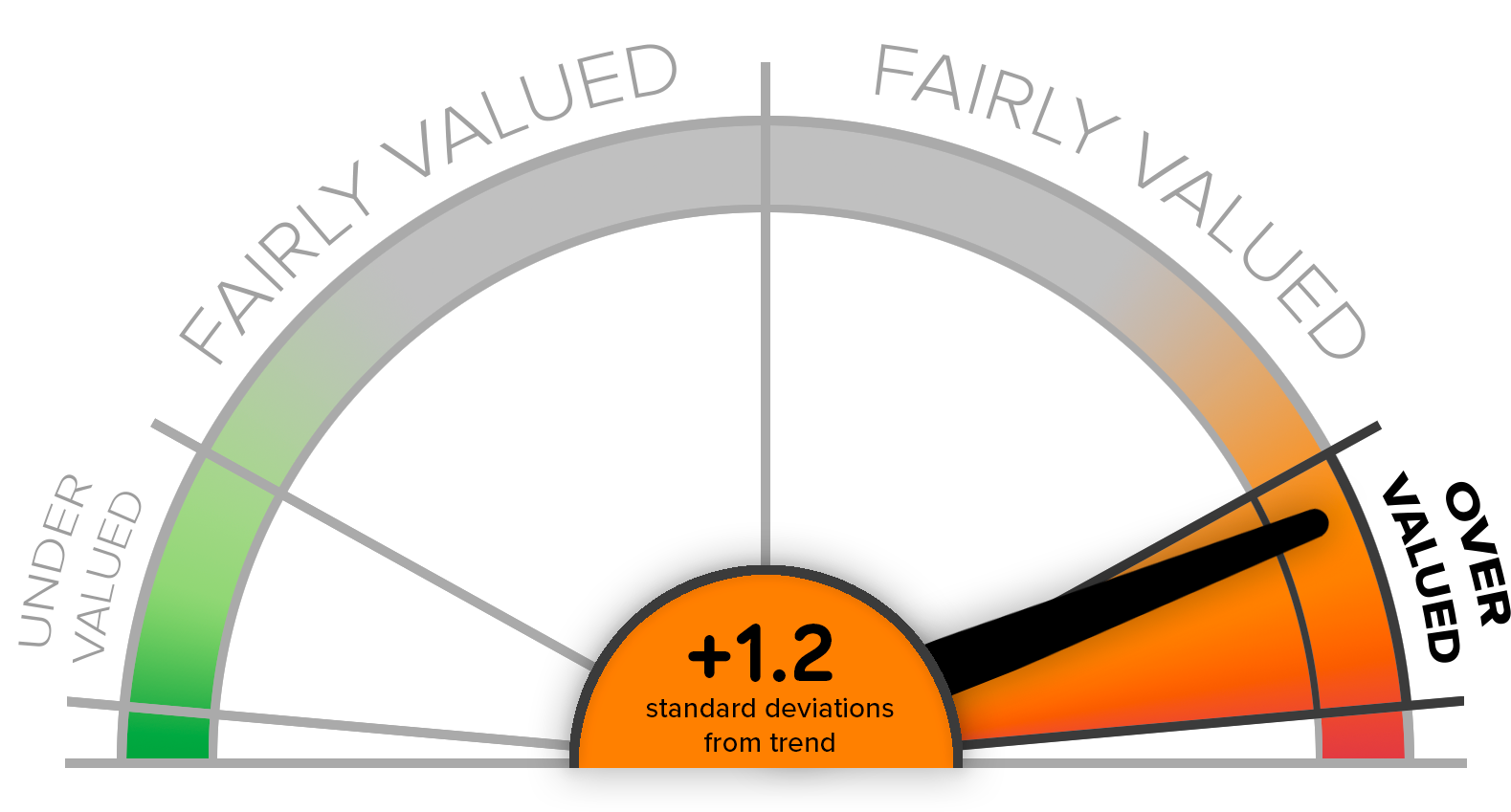

Market Model: Access to the CMV Aggregate Market Value Index, a weekly index score of overall stock market valuation

details below

Correlation: View detailed charts and metrics on how each valuation model correlates with market performance across different time horizons

If you don't love it, cancel with one click and you'll never be charged.

Data Download

$199/yr

Regular price $239/yrWeekly Updates: Every CMV model updated weekly*

Enhanced Charts: Every chart on each model page becomes interactive, showing additional detail and zoom/scan capability

Market Model: Access to the CMV Aggregate Market Value Index, a weekly index score of overall stock market valuation

details below

Correlation: View detailed charts and metrics on how each valuation model correlates with market performance across different time horizons

Downloads: Download up to 70 years historical data for select models (see detail here) in clean .xls format, in addition to new download files available each month with the latest model data

-

Use to better understand market cycles, or to inform your own market models

Note however that refunds are not available on digital download products, including the "Data Download" membership. Prior to purchase, please review the provided dummy data to ensure you're satisfied with the format and detail of the data product prior to purchase.

Model Update Timing

The update frequency for all models is shown below. Generally speaking, the public facing (non-member) website is updated 1.5 months after each quarter end. Members receive weekly data updates, as the data for each model becomes available (*exceptions noted below).

Current status for each model shown below.

Members |

Non-Members |

|||||

|---|---|---|---|---|---|---|

| Model | Currently Showing | Update Frequency | Next Update | Currently Showing | Update Frequency | Next Update |

| Buffett Indicator | Dec 12 | Weekly | Dec 20 | Sep 30 | Quarterly | On Feb 15, with Dec 31 data |

| P/E Ratio | Dec 12 | Weekly | Dec 20 | Sep 30 | ||

| Interest Rates | Dec 12 | Weekly | Dec 20 | Sep 30 | ||

| Mean Reversion | Dec 12 | Weekly | Dec 20 | Sep 30 | ||

| Earnings Yield Gap | Dec 12 | Weekly | Dec 20 | Sep 30 | ||

| Yield Curve | Dec 12 | Weekly | Dec 20 | Sep 30 | ||

| Sahm Rule | Sep 30 | Monthly | Dec 20 | Aug 31 | ||

| State Coincidence | Aug 31 | Monthly | Jan 03 | Aug 31 | ||

| Margin Debt | Nov 30 | Monthly | Dec 20 | Aug 31 | ||

| Junk Bond Spreads | Dec 12 | Weekly | Dec 20 | Sep 30 | ||

| VIX Fear Index | Dec 12 | Weekly | Dec 20 | Oct 01 | ||

Data Download Membership

Data Download members get access to everything Premium members do (including all models and the Aggregate Market Value Index, updated weekly). Additionally, this membership tier allows you to download a .xlsx file each month of select CMV models (see Demo file), for personal use in your own investment models. Below is a demo file, filled with dummy data, but in the same format as you'll receive as a member.

Demo Data

Since we cannot refund digital purchases, prior to purchase please download and review the above demo file to ensure that your expectations will be met. This file contains dummy data, but is representative of file you'll receive each month as a member.

Additional Details

Update Frequency

Paying members can access all models, updated weekly. Models with underlying data sources that are updated less frequently than weekly (e.g., GDP data is released quarterly, unemployment data released monthly, etc) will be updated with the most recent data available.

Returns/Refunds

There are no returns/refunds on membership. Premium membership includes a 7-day free trial - if you're unsatisfied in any way, you can cancel your membership in the first 7 days and never be charged. The Data Download membership has no trial, and no returns. Given the one-way nature of downloading the file after purchase, please understand that we cannot offer refunds. Please take a look at the demo file above prior to purchase to ensure that the data & formatting meet your expectations prior to purchase. If you have specific concerns or questions please get in touch prior to purchase at feedback@currentmarketvaluation.com.

Subscription and Cancellation

Subscriptions are renewed automatically at the end of each period, though you will receive a reminder email prior to renewal to remind you of your subscription and upcoming charge, and giving you time to cancel if you wish to do so. (All payments are made in US dollars.) You can cancel your membership at any time via one-click settings in your account profile. Membership is powered by MemberSpace and they make this process very simple.

Premium & Data Download Membership Terms of Use

- Data cannot be used for commercial purposes.

- Data cannot be resold or broadly redistributed or republished.

- Data is offered for sale and intended to be used for personal, non-commercial purposes - e.g., personal education, personal modeling, etc.

- Do not use data to republish materially similar charts, information, or analysis as can be found on www.currentmarketvaluation.com.

- To the extent the data is used to inform models or images published elsewhere, please attribute the data source as www.currentmarketvaluation.com.

Contact

To make changes to your membership, including cancellation, click the "Your Account" button at the top of the Membership page (visible when you are logged in). For other questions or feedback, contact us at feedback@currentmarketvaluation.com.